China’s policy makers see an important role for their currency Yuan, or Renminbi, in today’s and tomorrow’s world. Acceptance of the Yuan into the IMF’s currency basket for Special Drawing Rights (SDR) would mark an important step. After China’s decision to devalue its currency and following statements of international policymakers at the sidelines of the recent G20 meeting in Ankara, it will be probably only a matter of time before inclusion becomes a fact.

Global policymakers acknowledge role Yuan

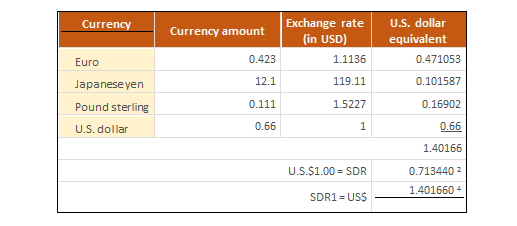

SDR’s are seen as a global monetary reserve currency, created by the International Monetary Fund (IMF). SDR’s are a global alternative to prevent dependency on one country’s currency, for example the US Dollar. The value is derived from a basket of the most important currencies used in global transactions, namely US Dollar, Euro, Pound Sterling and Yen.

The reflection of global trade in the SDR’s is exactly why the Yuan makes a realistic chance to be included soon. As German Central Bank President Weidmann puts it: “The currency basket by definition should mirror global economic forces. It is beyond doubt that China is an economic heavyweight (…)”. But also other emerging economies seek China’s inclusion. India’s Chief Economic Advisor Subramanian stated end of September that his country should encourage entry of the Yuan into IMF’s SDR. On the other end are the United States who are still skeptical due to China’s currency policy in the past. Nevertheless, the IMF welcomes a potential inclusion. Managing Director Christine Lagarde thinks it’s not a question if, but when the Yuan will be included in the currency basket. It may probably not happen in November’s board vote, but some economists expect that China’s bid has a realistic chance in Spring 2016. The vote needs a 70% majority.

Recent policy steps game changer

A major criteria for inclusion into the SDR basket is that a currency is “freely usable”. That means that the currency should be widely used in international transactions and is widely traded in the principal exchange markets. The IMF underlines that this doesn’t necessary means that the currency should be freely floating or fully convertible. Technically, the Yuan would meet both criteria. However, a currency with a hard peg is regarded as less ideal for the SDR basket by many economists. The recent devaluation of Yuan and a more flexible peg is seen as an important step, since it would indicate that the Yuan is in the process of getting more market related. Also indications that China’s policy makers may want to close the gap between “onshore” Yuan trading (with symbol CNY) and “offshore” Yuan trading (CNH) support this view. Due to capital controls, there’s still a difference, where CNH is seen as the market price. Potential measures to close the gap imply a more floating regime, with more focus on the market price instead of merely allowing more fluctuations around the flexible peg.

Shift in currency markets

The big question for investors is what the impact could be of an inclusion of the Chinese Yuan into the SDR basket. First, this would indicate that the Yuan is a world currency for global markets. Money managers and currency funds would seek (additional) exposure. Second, Central Banks across the globe would add the Yuan in their currency reserves when it is included in the SDR Basket. Demand for the currency could rise dramatically. This could also lead to more instruments denominated in Yuan. In the recent years, some major companies did already place Yuan debt issues, so called dim sum bonds. The size of this market is with USD 33.4 billion in 2014 and USD 16 million in 2015 up to end of September relatively modest. With larger use of the Yuan as a result of SDR-inclusion, this market could also be more attractive and grow significantly. It will be easier to hedge the currency risk for issuers and lenders. But more importantly, a SDR composition including Yuan would give China a far bigger role in the IMF and world economics.