During the recent weeks, markets show significant price movements. In other words, investors are confronted with increased volatility. Whereas the recent years showed a steady rise and the first half of 2015 a more or less stagnant S&P 500 and Dow Jones Index, we saw heavy price drops in September and September, but also stellar recovery in between. This may cause some nervousness for long term investors. But there are ETFs who should benefit from increased volatility, for example iPath S&P 500 VIX ST Futures ETN (symbol: VXX). Does this instrument offer a good protection against increased volatility?

Complex factor

Volatility is for most (private) investors a difficult concept to grasp. Basically it measures the speed of market movements. When share prices move fiercely, we speak of volatile markets. Markets become more uncertain as volatility rises, since price movements become more unpredictable. When a share price can change drastically in both directions over a short period of time, the volatility is high. For option traders, volatility is one of the, if not the, most important factors in determining a strategy. But also for stock investors the speed of price movements is important. As a rule of thumb, bear markets tend to be more volatile and bull markets show low volatility. A decline in share price is mostly sharp and an upward movement more steady. As the saying goes, risk happens fast. So one could argue that protection for volatility is more relevant if one expects a bear market or wants to protect profits in portfolio. But how can we protect our portfolio from volatility?

Range of instruments

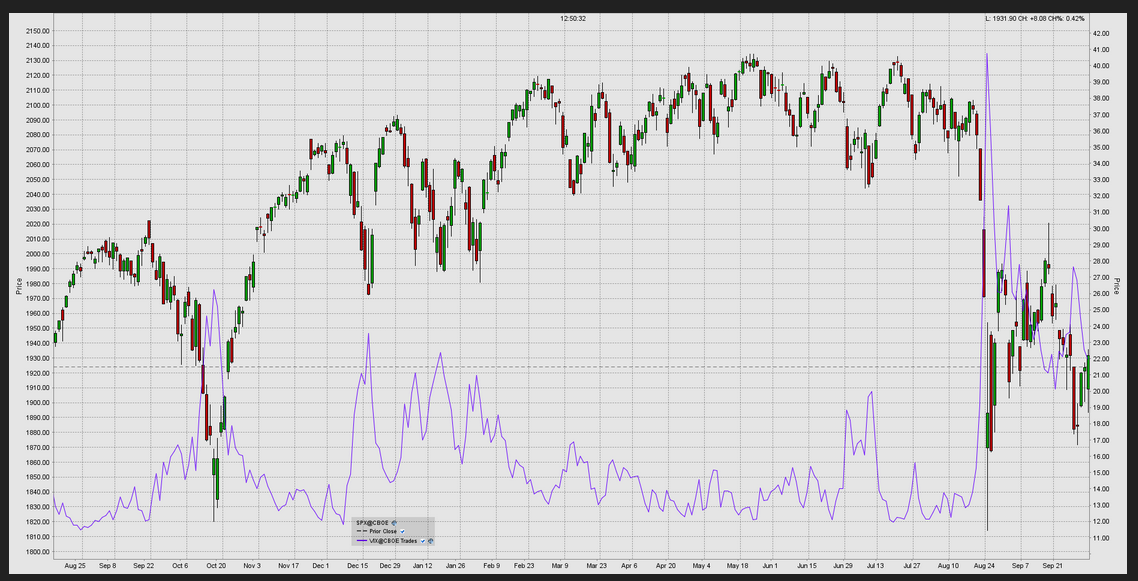

One of the most used benchmarks for volatility is the VIX, the S&P Volatility Future, as traded on the Chicago Board Options Exchange. For most investors this instrument is quite difficult to use, since futures need to be rolled over and one needs margin. But in today’s world, there are of course ETFs which track the development of the VIX. As mentioned in the introduction, the VXX is the most commonly used ETF. But do these instruments offer good protection? Chart 1 shows that the VIX shows an excellent negative correlation with the S&P 500 Index (SPX). Therefore it would offer great protection.

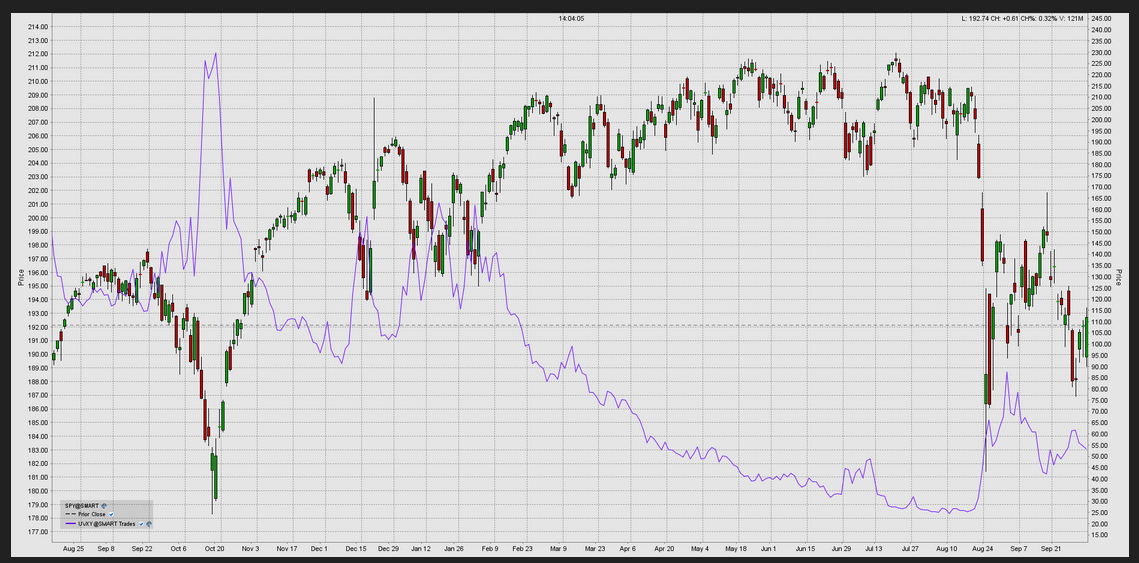

But let’s view the topic from an ETF investor’s point of view, since an index is not traded. The most common ETF, the SPDR S&P 500 ETF (SPY) is for a backbone in a lot of portfolios. Would the VXX ETF offer a good protection for an investment in SPY? Chart 2 shows that this is only partly true.

During more calm periods, or sideward price development, the decline in VXX is above average and does not track SPY very well. This means in the long run, the protection becomes less effective. Investors have to add additional shares of VXX to be fully protected. Therefore, investors should be careful with using VXX as protection for their portfolios. One has to time the market, and that’s something long term investors do not prefer to do. Buy and hold and sleep tight is not working here.

There’s an alternative for the VXX, the ProShares Ultra VIX Short-Term ETF (UVXY). This ETF tracks the VIX to two times of the daily performance. Let’s take a look what that means:

The protection becomes even worse if time advances, which is considering the development of the VXX logical. As a speculative instrument, the UVXY may be interesting, but as an instrument for protection for buy & hold investors certainly not.

Living with volatility

So what should long term investors do to protect their portfolios? There doesn’t seem to be a clear answer. Although VIX offers the best coverage of volatility, the need to periodically roll over and margin requirements make it less useful for most private investors. The ETF alternative is not attractive. However, if one has a more clear expectation of volatility ahead, VXX could be an option. There are option strategies which could offer some form of protection, however this is a more complex topic and only suitable for more experienced investors. In the long run, it may be unavoidable having an exposure to volatility…