As one of the fastest-growing financial technology companies, Chime is the golden middle between traditional banking and digital innovations. What clients love about Chime is the client-oriented policy, including benefits like no monthly fees, fee-free ATMs, and so much more. With Chime, traditional banking operations are straightforward and 100% free. So today, we’ll take a closer look at Chime and talk about the best way to deposit a check.

Step-by-step Guide to Deposit Check with Chime

As before, Chime is online-oriented. It means that if you want to deposit a check through Chime, you can do it online, using your smartphone, for example. Yes, there are no lines, no fees, and no paper forms that you need to fill. You don’t even have to visit a physical office. All you need is an Internet-enabled device in your pocket and a few minutes of your time.

Keep in mind that you can deposit up to 2,000 dollars using Chime Mobile Check Deposit, and it’s allowed to make up to 10 such deposits per month. Also, there is a mobile check limit - you can deposit 10,000 dollars max. With all said, let’s see how to deposit a check with chime. For experienced users, the process is very easy and fast.

There is nothing unusual about it. If you ever made a money transaction using your PC/smartphone, you won’t experience any difficulties. But even if you are an inexperienced user, just follow the steps below, and you’ll nail it:

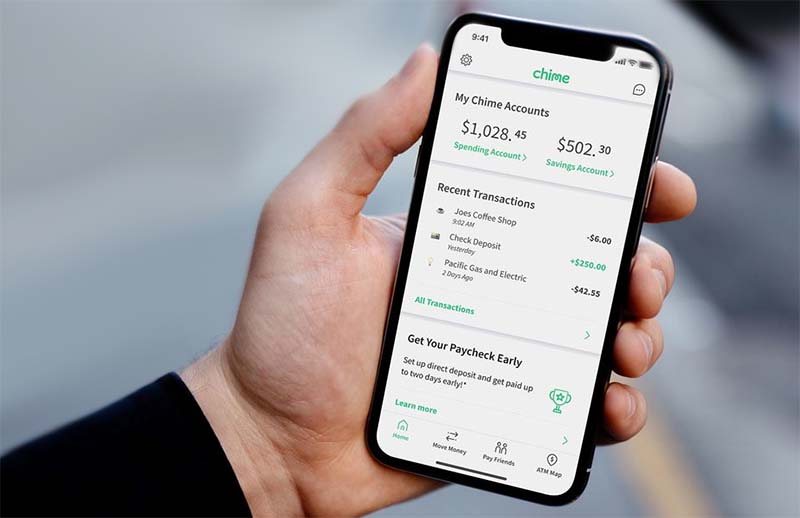

- Open your Chime Mobile App

- Tap ‘Move Money’

- Under ‘Add Funds’ you’ll find ‘Mobile Check’ - that’s what you need

- There are two types of accounts: checking and savings. Chose the one you want to deposit the check into

- Then, you need to type the exact amount you see on the check

- Now you must take clear pictures of both the front and the back of your check

- All is left to do is review the deposit details and confirm the deposit

Or, if you want to create an account on a PC/tablet, go to the official enrollment page. Next, just follow on-screen instructions and you’ll be done in a couple of minutes.

Sometimes, people have trouble with the 6th step, where they need to take pictures of the check. It is a very important step because if the photos are not good enough, the whole transaction will be canceled, regardless of whether you met all the other requirements. Taking a couple of clear, bright, well-illuminated pictures will take some trial and error: there is no need to hurry.

Here are some tips on how to take clear pictures of your checks:

Here are some tips on how to take clear pictures of your checks:

- Put your check on a clean, dark surface. Make sure there are no other items visible

- Light is key: so, use proper lighting for the photos

- All four corners of the check must be visible in the photograph

- Take the pictures.

That’s pretty much it!

More about Chime Mobile Check Deposit

Alright, now you know how to deposit checks with Chime. It’s quite a straightforward, ease-to-master procedure. And you can do it anytime, regardless of where you are. All you need is an Internet connection and your smartphone. Now it’s time to find out how long does Chime take to deposit a check? Well, that mostly depends on the banks. The thing is - different banks usually have different clearing times.

For one bank, it may take an hour or even less to give a green light to your transaction; at the same time, another bank may take a few days. So, when it comes to Chime mobile check deposit time, there is no set timeframe there. But, in most cases, it takes up to one week (max) for the transaction to go through.

If you feel like something went wrong or it’s been too long since you deposited a check and the money did not appear on your account, contact Chime’s hot line (the number is 1-844-244-6363). Or, you can send an email to customer support: support@chime.com. And one more thing: in case you were wondering whether you can send checks to yourself or even to other people using Chime, the answer is yes, you can.

Chime Check Deposit Limits

Usually, financial institutions impose certain limitations on the number of checks one can deposit per day/week/month, and Chime is no exception. There are also daily/weekly/monthly limits on the amount of money one can add to the bank account via a mobile check deposit. Here are Chime check deposit limits:

- You can deposit a maximum of 2,000 dollars per check using Chime mobile check deposit

- You can do up to 10 deposits a month

- The total amount of dollars you can deposit is limited to 10,000 dollars per month

How to Mobile Deposit Stimulus Checks with Chime

If you have a Chime account, you can deposit government stimulus paper checks that you receive using Chime’s mobile app, without any risks. Here is what you need to do:

- First things first, make sure the name on the check and the name of your Chime checking account are exactly the same

- In case it’s a joint check, at least one filer’s name and the name of the Chime account must match.

- Sign the back of the stimulus check. Write ‘For deposit to Chime only’ under your signature

- Go to the Chime App, tap Move Money, you’ll find it at the bottom of the screen. Next, tap Mobile Check Deposit. Next, U.S. Treasury

- You’re almost there: just follow the step-by-step guides of the Chime App to see the check deposit process through

Final Words

Nowadays, more and more people are finding digital technologies to be more comfortable, safe, and convenient. Digitalization is shaping our lives - the way we do business, communicate, and live. Each day, digital technologies change different aspects of our lives. And banking is no exception to the rule. As mentioned before, digital technologies make a lot of things faster and easier, and platforms like Chime are living proof of that.

With Chime, there is no need to get in line, there is no need to wake up early to get to the bank office. Convenience and client orientation - that’s what it’s all about. And that’s why Chime is becoming more and more popular with the people.

Frequently Asked Questions

Is Chime Mobile Check Deposit Instant?

Sometimes, it may take very little time; in other cases, it may take up to one week. That depends on the banks and their policy regarding transactions. There are some safety and clearing protocols banks follow, so there is no certain way to tell for sure. But, if there is nothing out of ordinary, it takes a maximum of one week for a transaction to go through.

If you feel like it’s taking too long, or just want to clarify a few things, it’s a good idea to check with the bank’s customer support. Before you do that, take a quick look at the Chime’s FAQ section. Chances are, you’ll find all the answers there.

Who is eligible to deposit checks with Chime?

Only those Chime users who have deposited at least 200 dollars into their accounts from regular payroll direct deposits are eligible to deposit checks using the Chime mobile check deposit option.

How much are the fees?

As we mentioned before, there are no fees related to Chime. But, if you use out-of-network ATMs for money withdrawal, there is a corresponding charge of two and a half U.S. dollars per transaction.

Can I cancel a Chime check while it is still in transit?

Yes, you can. But keep in mind that you are free to cancel only non-withdrawn checks. After the funds are released, you can’t retrieve those funds. So, make sure the check is still in transit - contact Chime customer service at 1-844-244-6363. Usually, after one business day, you’ll have the money back on your Chime account.

Is it safe to use mobile check deposits?

When it comes to using the Chime mobile check deposit, you can be sure that it’s safe and secure. However, when dealing with banking apps, you should be careful with your personal/banking information. Here are some useful tips that will help you keep your personal information safe:

- Don’t use public Wi-Fi when accessing your bank account or depositing a check through your mobile banking app

- Lock your smartphone or other mobile device using facial recognition or a password.

- Use long (10 symbols at least) and complex passwords, both on your mobile device and Chime account